top of page

Why Workplace Life Insurance Is Often Considered Supplemental Coverage Rather Than Primary Protection

Employer-provided life insurance is helpful but limited. It’s best seen as supplemental, with personal policies serving as primary protection.

Philippe Deray

Dec 14 min read

The Benefits of Wealth Preservation and the Various Life Insurance Options

Life insurance protects wealth, offers financial security, and supports long-term estate planning.

Philippe Deray

Dec 17 min read

Life Insurance Considerations for Individuals with Controlled Autoimmune Diseases

Controlled autoimmune diseases may still allow possible life insurance with proper management and documentation.

Philippe Deray

Nov 195 min read

Why Annual Reviews of Life Insurance and Annuities Are Crucial—and Why You Need a Trusted Advisor

Annual reviews of life insurance and annuities help ensure your coverage stays aligned with your life, with a trusted advisor guiding the way.

Philippe Deray

Nov 134 min read

Mistakes a Local Advisor Can Help You Avoid When Choosing an Annuity

A local advisor helps you navigate annuities, avoid costly mistakes, and align your retirement plan with your goals.

Philippe Deray

Nov 133 min read

Fast Life Insurance Without a Medical Exam: What You Need to Know

No-exam life insurance lets you secure coverage quickly without medical tests. Learn about guaranteed and simplified issue policies, coverage limits, and what to expect from premiums.

Philippe Deray

Nov 133 min read

Understanding Term Conversion: Protecting Your Future Options in Life Insurance

Term conversion lets you switch to permanent life insurance for long-term coverage and peace of mind.

Philippe Deray

Nov 64 min read

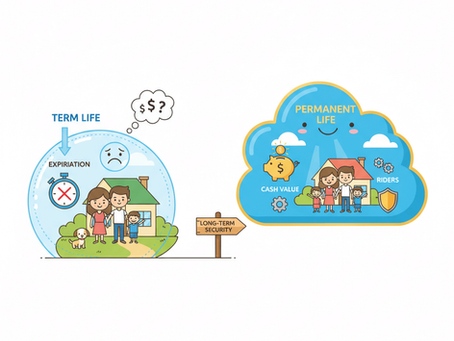

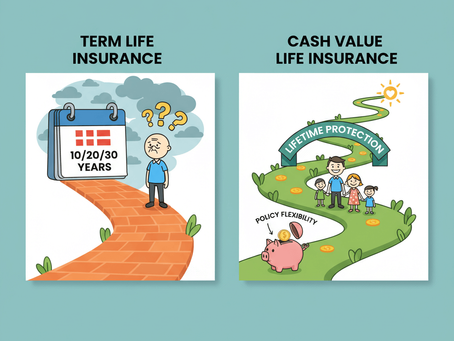

Don’t Let Term Life Expire — Why Permanent Life Insurance Might Be a Better Choice

Term life insurance provides temporary coverage, but permanent life insurance offers lifetime protection with flexible policy features and cash value access.

Philippe Deray

Nov 52 min read

Make Your Life Insurance Work Smarter — Understanding Cash Value Policies

Cash value life insurance offers lifetime protection, flexibility, and access to policy funds, providing long-term financial security beyond term coverage.

Philippe Deray

Nov 52 min read

💡 What Is Level Term Life Insurance?

Level term life insurance provides affordable, temporary protection to ensure your family or business is secure today. While it offers high coverage at lower premiums, converting to permanent life insurance later can provide lifelong security, cash value growth, and long-term financial flexibility.

Philippe Deray

Nov 44 min read

Should You Accept a Rated Life Insurance Policy or Explore Better Options?

Receiving a rated life insurance policy doesn’t mean you’re out of options. With the right strategy—and the right agent—you can often find better coverage, lower premiums, or improved terms. Don’t settle for the first offer; explore your options and make informed decisions that protect your financial future.

Philippe Deray

Oct 303 min read

Why “Tax‑Deferred + Downside Protection” Can Beat a Raw Stock Market Bet for Many Investors

While the stock market offers high potential returns, volatility and taxes can erode growth. An Indexed Universal Life (IUL) policy provides tax‑deferred, protected growth with a death benefit, making it a strategic complement for long‑term wealth planning when structured properly.

Philippe Deray

Oct 304 min read

bottom of page