top of page

Life Insurance Considerations for Recreational Scuba Divers

Recreational scuba diving carries risks, but divers may possibly secure life insurance by following safety guidelines and maintaining good health.

Philippe Deray

Nov 194 min read

Life Insurance for Recreational Skiers and Snowboarders: Navigating Risk and Coverage

Recreational skiing and snowboarding carry risks, but with good health, proper safety practices, and honest disclosure, enthusiasts may possibly obtain life insurance coverage despite their high-risk hobby.

Philippe Deray

Nov 194 min read

Life Insurance Considerations for Individuals with a History of Depression or Anxiety

A history of depression or anxiety doesn’t bar life insurance—effective management and transparency can possibly secure coverage.

Philippe Deray

Nov 194 min read

Life Insurance Considerations for Individuals with Controlled Autoimmune Diseases

Controlled autoimmune diseases may still allow possible life insurance with proper management and documentation.

Philippe Deray

Nov 195 min read

History of Previous Minor Strokes or TIAs: Life Insurance Considerations

A history of minor strokes or TIAs doesn’t prevent you from possibly obtaining life insurance with proper management and planning.

Philippe Deray

Nov 194 min read

Life Insurance Considerations for Individuals with a History of Cancer (In Remission)

Cancer in remission doesn’t block life insurance—time since treatment, cancer type, and health all influence possible coverage.

Philippe Deray

Nov 194 min read

Life Insurance and Managed Thyroid Disorders: Understanding Your Options

Properly managed thyroid disorders, with regular monitoring and stable hormone levels, may possibly allow individuals to obtain life insurance coverage.

Philippe Deray

Nov 193 min read

Mountain Biking or Trail Biking and Life Insurance

Mountain biking is high-risk but insurable for recreational riders who follow safety guidelines and disclose their activity.

Philippe Deray

Nov 182 min read

Recreational Skydiving and Life Insurance

Skydiving is an exhilarating, high-risk activity, but with proper training, adherence to safety protocols, and honest disclosure, most enthusiasts can still secure life insurance coverage.

Philippe Deray

Nov 182 min read

Recreational Scuba Diving and Life Insurance

Recreational scuba diving can be insured when done responsibly within established safety limits. Certification, health, and adherence to protocols affect coverage and premiums.

Philippe Deray

Nov 182 min read

Life Insurance for Individuals with Mild Obesity (BMI Slightly Above Normal)

Mild obesity can affect life insurance rates, but applicants who maintain good health and manage their weight often remain insurable.

Philippe Deray

Nov 182 min read

Life Insurance for Individuals with High Cholesterol (Managed with Medication)

People with high cholesterol who manage it through medication and healthy lifestyle choices may still qualify for life insurance, though approval is not guaranteed.

Philippe Deray

Nov 172 min read

Life Insurance for Individuals with Controlled Diabetes

Even with well-managed diabetes, individuals can qualify for life insurance by maintaining healthy habits, keeping detailed medical records, and working with insurers, though approval is not guaranteed.

Philippe Deray

Nov 172 min read

Life Insurance Considerations for Individuals with Controlled Hypertension (High Blood Pressure)

Controlled hypertension can be managed effectively, and maintaining healthy lifestyle habits, medication compliance, and regular monitoring can improve life insurance eligibility.

Philippe Deray

Nov 172 min read

Ever Wondered About Life Insurance? It’s More Affordable Than You Think

Life insurance isn’t just for the wealthy or older adults—it’s a practical, affordable way to protect your loved ones and ensure financial security, even with a modest budget.

Philippe Deray

Nov 134 min read

Why Annual Reviews of Life Insurance and Annuities Are Crucial—and Why You Need a Trusted Advisor

Annual reviews of life insurance and annuities help ensure your coverage stays aligned with your life, with a trusted advisor guiding the way.

Philippe Deray

Nov 134 min read

The Value of Very Small Face Amount Life Insurance Policies

Small life insurance policies, ranging from $5,000 to $50,000, provide affordable protection for final expenses, help cover debts, and give peace of mind to loved ones.

Philippe Deray

Nov 133 min read

Understanding Term Conversion: Protecting Your Future Options in Life Insurance

Term conversion lets you switch to permanent life insurance for long-term coverage and peace of mind.

Philippe Deray

Nov 64 min read

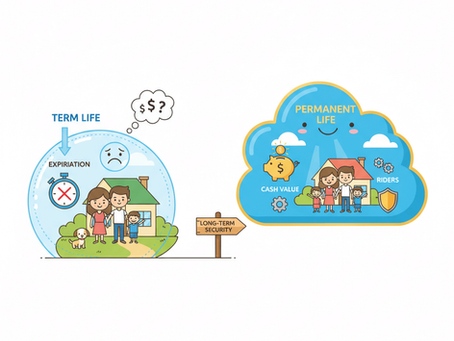

Don’t Let Term Life Expire — Why Permanent Life Insurance Might Be a Better Choice

Term life insurance provides temporary coverage, but permanent life insurance offers lifetime protection with flexible policy features and cash value access.

Philippe Deray

Nov 52 min read

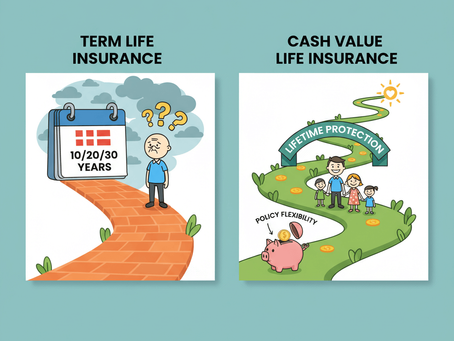

Make Your Life Insurance Work Smarter — Understanding Cash Value Policies

Cash value life insurance offers lifetime protection, flexibility, and access to policy funds, providing long-term financial security beyond term coverage.

Philippe Deray

Nov 52 min read

bottom of page