How A Stepwise Approach Might Improve Your Chances with Insurance Applications

- Philippe Deray

- Dec 3

- 3 min read

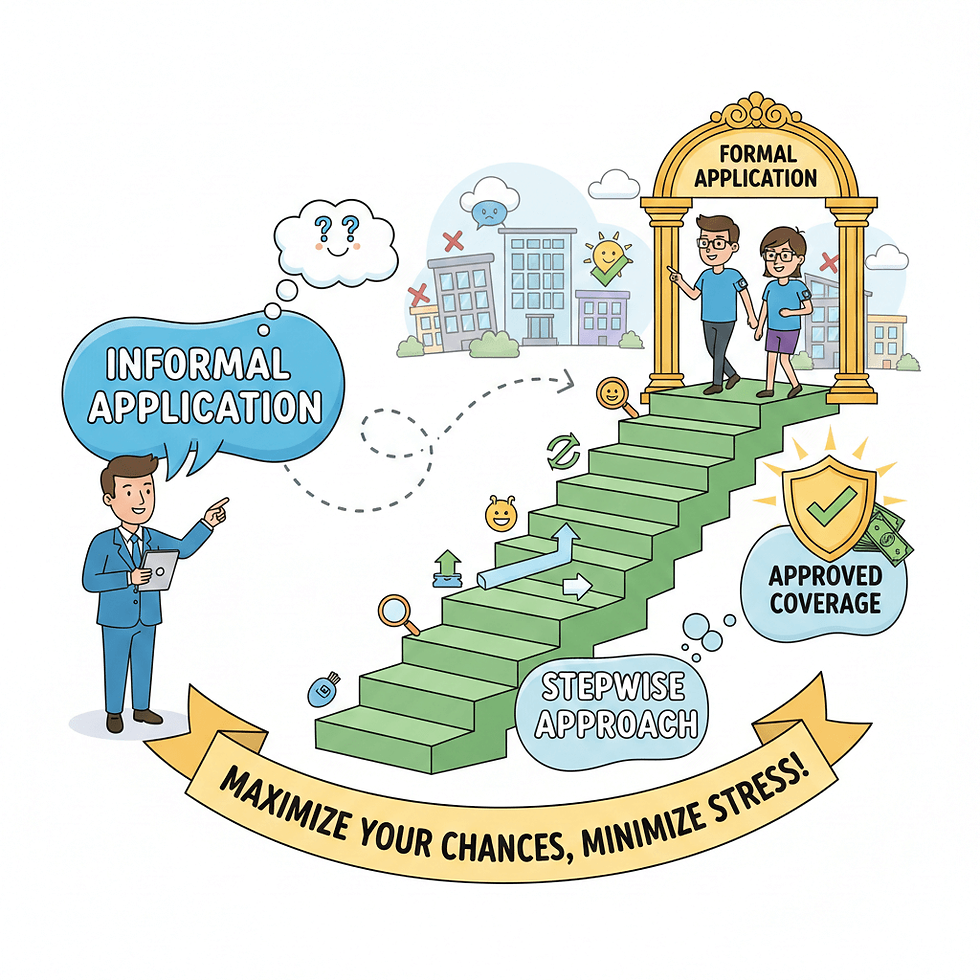

When it comes to applying for life insurance, having a history of certain medical conditions—like diabetes—can make the process feel intimidating. Many individuals in this situation are unsure how to proceed and worry about being automatically declined. That’s where having a knowledgeable guide and a thoughtful application process can make a world of difference. At our firm, we take a methodical approach designed to maximize your chances of success while minimizing unnecessary stress.

Starting with an Informal Application

Rather than diving straight into a formal insurance application, we sometimes recommend beginning with an informal or “search” application. This preliminary step is not a binding or final application; instead, it’s a way for us to gauge the response from the companies we work with. Think of it as a first conversation with the insurer without fully committing to the process.

The benefit of this approach is twofold. First, it allows us to determine which insurers we represent are likely to be interested in offering coverage. Second, it might avoids the risk of an automatic decline from a company that may not have been a good match. This is particularly important for individuals with pre-existing conditions, such as diabetes, where careful navigation might impact the outcome.

Why This Step Matters

Submitting a standard application right away can sometimes lead to unnecessary declines. Once a formal decline is recorded, it might affect your ability to get coverage elsewhere or complicate future applications. By starting with an informal application, we reduce the likelihood of these setbacks. It gives us the ability to target insurers who are more likely to consider your specific situation, providing a more strategic path forward.

Additionally, this process allows us to gather more information, prepare you for what insurers may ask, and craft an application that presents your case in the best possible light. This proactive strategy might often leads to better outcomes and a smoother overall experience.

Transitioning to a Formal Application

If the informal application shows potential—that is, if there is a realistic chance that an insurer will extend an offer—we then move forward with the formal application. It’s important to understand that this step does not guarantee approval. However, because it is informed by the results of the informal application, the likelihood of a positive outcome is higher than submitting a standard application without prior assessment.

Our goal throughout this process is to balance efficiency with strategy. We aim to prevent unnecessary declines while still moving quickly enough to secure coverage when possible. For many clients, this stepwise approach provides peace of mind, clarity, and a better overall experience.

The Value of Expert Guidance

One of the most critical aspects of this process is having a trusted expert to guide you. Navigating insurance applications—especially with a medical history like diabetes—can be overwhelming. There are many options, each with its own criteria, and understanding which path to take requires experience and insight.

By working with an expert, you gain a partner who can evaluate your situation, identify the insurers likely to provide favorable terms, and manage the application process efficiently. Rather than spending countless hours searching online, comparing companies, or risking missteps, you have a clear strategy tailored to your circumstances.

Conclusion

Applying for life insurance doesn’t have to be stressful or discouraging. With a stepwise approach that begins with an informal application, guided by an experienced professional, you can maximize your chances of success while minimizing risk. For individuals with pre-existing conditions such as diabetes, this method provides a thoughtful, strategic path to coverage—one that avoids unnecessary declines and helps secure the protection you need.

If you’re considering life insurance and want a process designed to possibly give you the best possible outcome, starting with an expert-led, stepwise approach can make all the difference.

Life Insurance Disclaimer

Disclaimer: This article is for informational purposes only and is not legal, financial, or insurance advice. Life insurance needs and products vary by individual, state, and insurer. Policies may involve fees, costs, and limitations. Some policies include a cash value component that can grow over time, and certain strategies may allow for accumulation beyond basic protection. Results are not guaranteed and may vary by policy, insurer, and state. Consult a licensed insurance professional before making any life insurance decisions.

#LifeInsuranceTips #InsuranceGuidance #DiabetesAndInsurance #InsuranceApproval #ExpertAdvice #InsuranceStrategy #FinancialProtection #CoverageMatters #InsuranceHelp #StepByStepInsurance

Comments