top of page

Don’t Delay: Why Getting Life Insurance Now Is the Smartest Move You Can Make

Delaying life insurance can cost more than you think. Even a small policy today protects your family, secures your future, and keeps your options open for tomorrow. Start now, adjust later.

Philippe Deray

Nov 255 min read

Life Insurance Considerations for Construction Workers: Navigating High-Risk Occupations

Construction workers face high risks from falls, heavy machinery, and job site hazards, yet life insurance is still possible with coverage tailored to their safety record and health.

Philippe Deray

Nov 244 min read

Life Insurance for Lifeguards and Water Rescue Personnel: Navigating High-Risk Coverage

Lifeguards face unique risks, but with training, safety, and good health, they can possibly secure life insurance coverage for their families.

Philippe Deray

Nov 204 min read

Life Insurance for Commercial Fishermen and Offshore Fishing Crew: Navigating High-Risk Coverage

Commercial fishermen face extreme risks, but with safety measures and good health, life insurance is still possible to protect their families.

Philippe Deray

Nov 204 min read

Life Insurance for Amateur Adventure Sports Enthusiasts: Kayaking and Whitewater Rafting

Kayaking and whitewater rafting are high-risk activities, but with safety measures and good health, participants may potentially secure life insurance coverage.

Philippe Deray

Nov 204 min read

Life Insurance for Recreational Horseback Riders: What You Need to Know About Possible Approval

Recreational horseback riding carries risks, but many casual riders may possibly be considered for life insurance. Knowing how insurers assess riding type, frequency, and safety can help secure coverage.

Philippe Deray

Nov 205 min read

Life Insurance for Sailors and Small-Boat Racers: What You Need to Know Before Applying

Sailing and small-boat racing carry unique risks, but with safety measures and experience, individuals may possibly obtain life insurance reflecting their lifestyle.

Philippe Deray

Nov 205 min read

Life Insurance for Amateur Martial Artists and Boxers: Navigating Coverage in a High-Risk Hobby

Amateur martial artists and boxers may possibly secure life insurance by practicing safely and maintaining good health.

Philippe Deray

Nov 204 min read

Life Insurance Considerations for Recreational Scuba Divers

Recreational scuba diving carries risks, but divers may possibly secure life insurance by following safety guidelines and maintaining good health.

Philippe Deray

Nov 194 min read

Life Insurance for Recreational Skiers and Snowboarders: Navigating Risk and Coverage

Recreational skiing and snowboarding carry risks, but with good health, proper safety practices, and honest disclosure, enthusiasts may possibly obtain life insurance coverage despite their high-risk hobby.

Philippe Deray

Nov 194 min read

Life Insurance Considerations for Individuals with a History of Depression or Anxiety

A history of depression or anxiety doesn’t bar life insurance—effective management and transparency can possibly secure coverage.

Philippe Deray

Nov 194 min read

Life Insurance and Managed Thyroid Disorders: Understanding Your Options

Properly managed thyroid disorders, with regular monitoring and stable hormone levels, may possibly allow individuals to obtain life insurance coverage.

Philippe Deray

Nov 193 min read

Life Insurance for Individuals with High Cholesterol (Managed with Medication)

People with high cholesterol who manage it through medication and healthy lifestyle choices may still qualify for life insurance, though approval is not guaranteed.

Philippe Deray

Nov 172 min read

Life Insurance for Individuals with Controlled Diabetes

Even with well-managed diabetes, individuals can qualify for life insurance by maintaining healthy habits, keeping detailed medical records, and working with insurers, though approval is not guaranteed.

Philippe Deray

Nov 172 min read

Life Insurance Considerations for Individuals with Controlled Hypertension (High Blood Pressure)

Controlled hypertension can be managed effectively, and maintaining healthy lifestyle habits, medication compliance, and regular monitoring can improve life insurance eligibility.

Philippe Deray

Nov 172 min read

Understanding Term Conversion: Protecting Your Future Options in Life Insurance

Term conversion lets you switch to permanent life insurance for long-term coverage and peace of mind.

Philippe Deray

Nov 64 min read

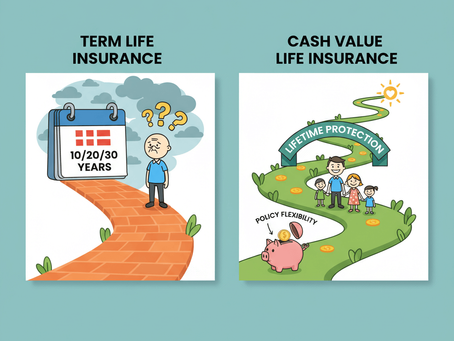

Make Your Life Insurance Work Smarter — Understanding Cash Value Policies

Cash value life insurance offers lifetime protection, flexibility, and access to policy funds, providing long-term financial security beyond term coverage.

Philippe Deray

Nov 52 min read

Life Insurance and Crohn’s Disease: What You Need to Know

Crohn’s disease doesn’t prevent life insurance. With preparation and the right agent, you can find suitable coverage.

Philippe Deray

Nov 44 min read

Understanding Term Life Insurance: Protecting Your Loved Ones

Term life insurance provides affordable, temporary coverage to protect your loved ones financially in case of the unexpected.

Philippe Deray

Nov 43 min read

💡 What Is Level Term Life Insurance?

Level term life insurance provides affordable, temporary protection to ensure your family or business is secure today. While it offers high coverage at lower premiums, converting to permanent life insurance later can provide lifelong security, cash value growth, and long-term financial flexibility.

Philippe Deray

Nov 44 min read

bottom of page