Why a Licensed Life Insurance Broker Makes All the Difference—Especially with Health Concerns

- Philippe Deray

- Dec 4

- 3 min read

In today’s world, life insurance is just a click away. Online applications promise instant quotes and rapid approvals with a few simple clicks. It’s easy to feel accomplished, having submitted multiple applications across different platforms and seen a variety of numbers pop up on your screen. But for many people, especially those with health concerns or a non-perfect health history, this “click-and-go” approach is far from ideal.

Life insurance underwriting isn’t about luck; it’s about information.

Licensed agents and brokers who specialize in life insurance understand the process inside and out. They know that every piece of information—medical history, lifestyle factors, medications, lab results, and even prior insurance experiences—can affect your approval and your rates. Without someone knowledgeable guiding the process, applicants risk submitting incomplete or misunderstood information that can result in denials, higher rates, or missed opportunities for better coverage.

For individuals with health challenges, the application process can be significantly more involved. It may require hours of back-and-forth communication with the underwriter, gathering supporting documents, clarifying medical history, and sometimes providing additional context that a standard online form simply doesn’t capture. A broker knows the right questions to ask and the kind of documentation that can make the difference between a declined application and an approval—or between a standard rate and a preferred one.

Even those who were previously declined or assigned a high-risk rating may find new options when working with a broker. Underwriters are not trying to be difficult; their goal is to make accurate risk assessments based on the information available. By presenting comprehensive, well-organized information, brokers can sometimes secure approvals that might not have been possible before—or negotiate a more favorable rating with the same insurance company. This is not just about filling out forms; it’s about advocacy, knowledge, and experience.

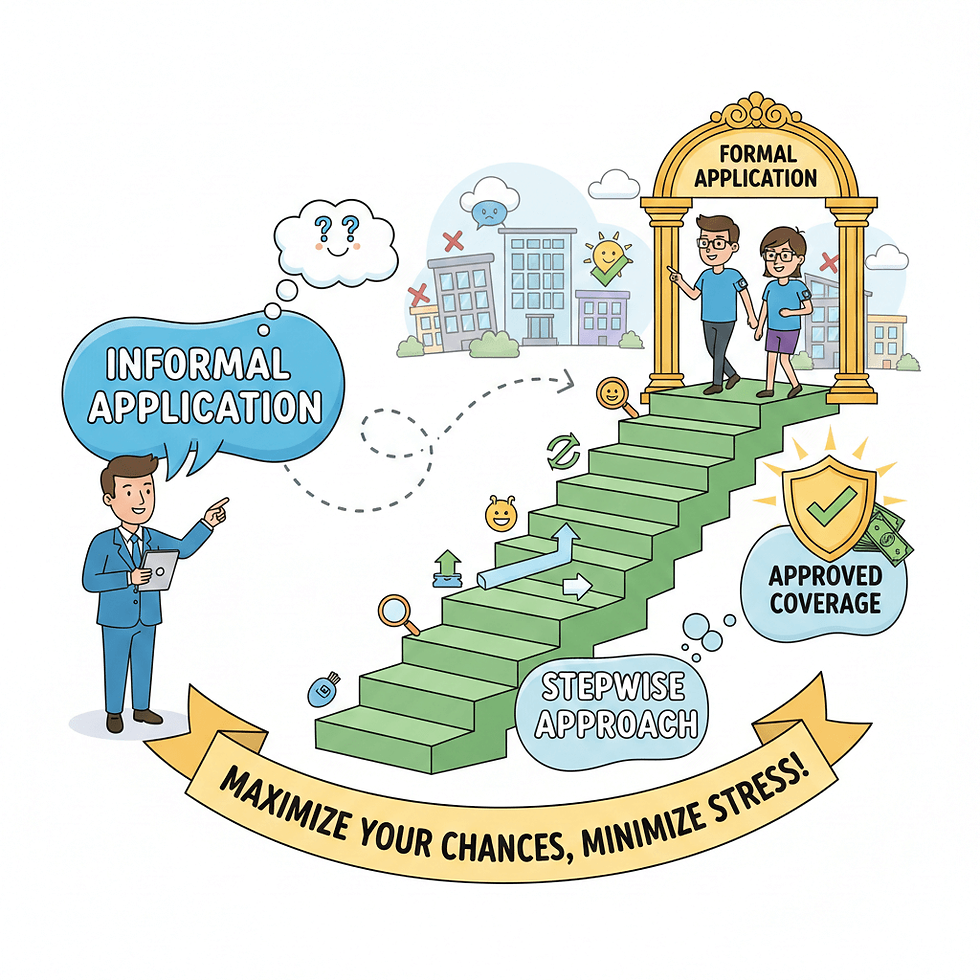

One tool brokers often use is an informal application. This preliminary step allows underwriters to assess risk without committing the applicant to a full policy. It’s a way to gauge what the likely outcome might be, identify gaps in information, and determine strategies for improving the chances of approval. For someone with complex health factors, this step can save time, effort, and stress, and increase the odds of securing the best possible coverage.

The process of securing life insurance is not inherently simple when health issues are involved. It demands careful navigation, thoughtful presentation of medical information, and strategic decision-making—tasks that most people cannot reasonably expect to manage on their own through an online portal. Brokers invest the time and effort to follow through, ensuring that every possible option is explored and that nothing is left to chance.

Relying solely on online applications is essentially leaving your life insurance outcomes to luck. While it’s true that some applicants with perfect health may receive quick approvals, those with more complicated histories face a different reality. Without a professional advocate, there is a real risk of unnecessary denials, inflated rates, or missing coverage options that could have been attainable.

Ultimately, the value of working with a licensed life insurance broker lies in expertise and diligence. Brokers understand the nuances of underwriting, the differences between insurance companies, and the strategic steps that can influence outcomes. They provide guidance tailored to individual circumstances, particularly when health concerns add layers of complexity. This ensures that applicants are not merely clicking their way through applications, hoping for the best, but actively engaging in a process designed to achieve the best possible results.

For anyone with a health history that isn’t perfect, taking the time to work with a knowledgeable professional isn’t just helpful—it can make a substantial difference in coverage availability, premium rates, and peace of mind. Life insurance is too important to leave to chance. By partnering with a broker, applicants gain advocacy, strategy, and the confidence that every possible avenue is being explored to secure the coverage they deserve.

In conclusion, while online applications may feel convenient, they are rarely a substitute for professional guidance—especially when health concerns are involved. A licensed life insurance broker brings hours of effort, understanding of complex underwriting, and access to multiple strategies that can transform a difficult application into a successful one. Choosing a broker is not just about avoiding mistakes; it’s about maximizing opportunity, ensuring proper coverage, and avoiding the unpredictable nature of luck. In life insurance, preparation and expertise consistently outperform a simple click of a button.

Life Insurance Disclaimer

Disclaimer: This article is for informational purposes only and is not legal, financial, or insurance advice. Life insurance needs and products vary by individual, state, and insurer. Policies may involve fees, costs, and limitations. Some policies include a cash value component that can grow over time, and certain strategies may allow for accumulation beyond basic protection. Results are not guaranteed and may vary by policy, insurer, and state. Consult a licensed insurance professional before making any life insurance decisions.

#LifeInsuranceWithHealthConcerns #InsuranceBeyondClicks #BrokerGuidanceMatters #HealthHistoryInsurance #SmartInsuranceChoices #MaximizeApproval #LifeInsuranceAdvocate #SkipTheGuesswork #ExpertInsuranceHelp #InsuranceNotLuck

Comments